Do Asian Family Businesses Destroy Themselves?

Research by Prof. Joseph Fan, Professor of School of Accountancy and Department of Finance and Co-director of Centre for Economics and Finance at The Chinese University of Hong Kong (CUHK) Business School, shows that the transfer of Asian family businesses from one generation to another can ruin a company.

Family businesses the world over face the same difficulty in succession, the issue of transferring the company from one generation to the next. One generation creates wealth, the next maintains it and the third wastes it, conventional wisdom holds.

But the problem is even more severe in Asia. In fact, Asian family firms lose almost 60 percent of their value in the first transfer of power when the founder steps down, according to research by Prof. Fan.

“I have never seen any corporate event that is more serious,” Prof. Fan says, in his 20 years in studying Asian companies. “This event is comparable to corporate bankruptcy.”

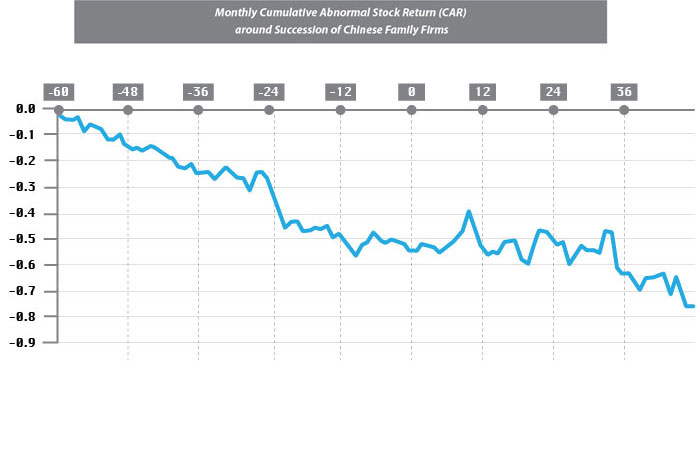

Prof. Fan’s findings, which have led to a new book he co-authored with Morten Bennedsen of INSEAD — The Family Business Map: Assets and Roadblocks in Long Term Planning, came from sampling 217 Chinese-run publicly listed companies across Hong Kong, Singapore and Taiwan. He examined the share price of a family company from five years before the year that the founder steps down to three years after a successor takes over. Leading up to the handover, 56 percent of the company’s value was lost, with another 2.9 per cent lost after the transfer of power.

(Source: The Family Business Map: Framework, Selective Survey, and Evidence from Chinese Family Firm Succession)

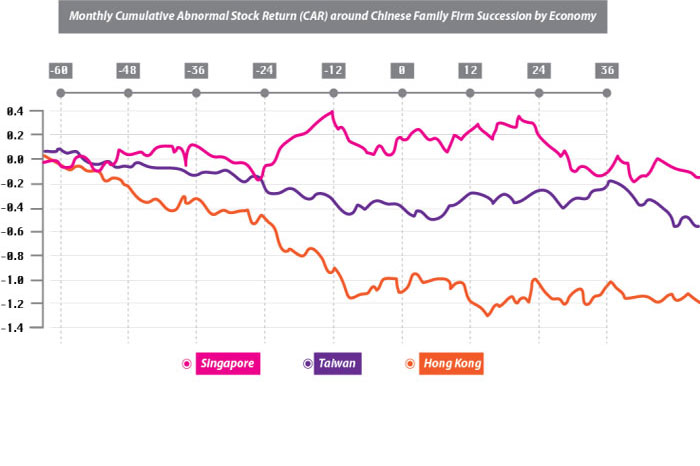

Taiwanese businesses showed the highest propensity for a family transition, with 74 percent of companies handed down to heirs or close family members. Hong Kong was similar at a rate of 69 percent, with only 36 percent of companies in Singapore passed down to the next generation.

The dissipation of wealth was the lowest with Singaporean companies, although they still lost 22 percent of their value. Taiwanese companies saw almost one-third (31 percent) of their value destroyed. Hong Kong companies are the most affected – they lost 126 percent of their value, meaning not only would “buy and hold” investors have lost all the money they invested in the company, but they would have contributed added funds during the nine-year transfer period and lost those as well.

The reasons for the decline in the company’s value are still something of a puzzle, and something Prof. Fan continues to analyze, even after five years of work on the topic. But he has ruled out that the decline is caused by the incompetence of the successor since the decaying of the company in fact slowed down dramatically after the transfer of power.

“The value destruction started well before the successor took over,” Prof. Fan notes. “It can’t be that it’s solely the cause of the successor.”

(Source: The Family Business Map: Framework, Selective Survey, and Evidence from Chinese Family Firm Succession)

His best theory is that much of the value in an Asian family business is intangible – investors look at who is running a company and what the owner’s values are, when determining whether or not to invest. That’s far more important than the fundamental analysis of revenues and earnings that would drive the investment decision in the West.

Asian families are much more hands-on with their businesses than their counterparts in the West, where the descendants of a founder typically eventually withdraw from working at the company. So it is the values of the founder and his family that explain the company’s success, according to Prof. Fan, who holds a position in Department of Finance and School of Accountancy at CUHK Business School. The value also comes from their connections and reputation in society, including with the government and the financial sector.

Most prominent companies across Southeast Asia were started by ethnic Chinese businessmen, who often bring Confucian cultural beliefs such as hard work and respect of elders as well as traditional Chinese beliefs such as ancestor worship to their company.

“They are usually well-connected and respected in their local communities,” Prof. Fan says. “They can often leverage up this sense of identity so that they work hard to sustain themselves and their family.”

“Chinese business families should begin to plan their family and business future 20 years before the old generation retires,” Prof. Fan says, because it takes that long to transfer the intangibles. “You have to start when the child is born. Otherwise the dissipation is inevitable.”

That’s because it takes two decades or more to cultivate intangible assets such as values and relationships and convey them to the younger generation. In the West, century-old business families such as Wendel and Mulliez in France have succeeded at that thanks to robust family governance, often with roots in a particular religious background.

There had been scant research on Asian family businesses when Prof. Fan began to study them 20 years ago. He specialized in corporate governance, leading to his interest in family businesses, which face issues over how to structure their boards fairly.

For Chinese version, please click here.

By Alex Frew McMillan

This article was first published in the CUHK website in November 2014. Please click here to read more.