Li Ka-shing’s Exit Plan Marks End of Era for Asia’s Tycoons

The curtain is falling on a generation of Asia’s tycoons who forged vast fortunes in the fires of the region’s political and economic upheaval of the past half-century. Prof. Joseph Fan told The Wall Street Journal that “Li Ka-shing’s key asset is his outstanding relationships and those relationships aren’t easily transferred.”

The curtain is falling on a generation of Asia’s tycoons who forged vast fortunes in the fires of the region’s political and economic upheaval of the past half-century.

Hong Kong billionaire Li Ka-shing, for decades one of the world’s richest people, has told associates that he plans to step down as chairman of his flagship conglomerate, CK Hutchison Holdings Ltd., by next year, when he turns 90, according to people briefed by Li.

Passing the baton to his previously anointed successor, his older son, Victor Li, would represent the most significant corporate abdication yet among an elite of aging billionaires in Hong Kong and Southeast Asia. These tycoons combined business savvy and carefully cultivated political connections—often with authoritarian governments—to prosper in Asia’s postcolonial economies and, more recently, from China’s economic opening.

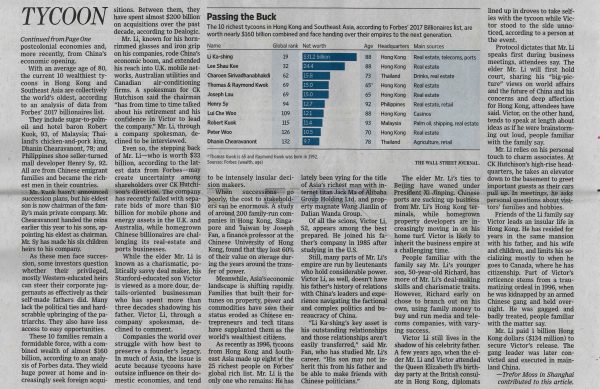

With an average age of 80, the current 10 wealthiest tycoons in Hong Kong and Southeast Asia are collectively the world’s oldest, according to an analysis of data from Forbes’ 2017 billionaires list. They include sugar-to-palm-oil and hotel baron Robert Kuok, 93, of Malaysia; Thailand’s chicken-and-pork king, Dhanin Chearavanont, 78; and Philippines shoe seller-turned mall developer Henry Sy, 92.

As these men face succession, some investors question whether their privileged, mostly Western-educated heirs can steer their corporate juggernauts as effectively as their self-made fathers did. Many lack the political ties and hardscrabble upbringing of the patriarchs. They also have less access to easy opportunities.

While the elder Li is known as a charismatic, politically savvy deal maker, his Stanford-educated son Victor is viewed as a more dour, detail-oriented businessman who has spent more than three decades shadowing his father.

Companies the world over struggle with how best to preserve a founder’s legacy. In much of Asia, the issue is acute because tycoons have outsize influence on their domestic economies, and tend to be intensely insular decision makers.

When successions go poorly, the cost to stakeholders can be enormous. A study of around 200 family-run companies in Hong Kong, Singapore and Taiwan by Joseph Fan, professor of the School of Accountancy and the Department of Finance and co-director of Center for Economics and Finance at the Chinese University of Hong Kong (CUHK) Business School, found that they lost 60 percent of their value on average during the years around the transfer of power.

Of all the scions, Victor Li, 52, appears among the best prepared. He joined his father’s company in 1985 after studying in the United States.

Still, many parts of Li’s empire are run by lieutenants who hold considerable power. Victor Li, as well, doesn’t have his father’s history of relations with China’s leaders and experience navigating the factional and complex politics and bureaucracy of China.

“Li Ka-shing’s key asset is his outstanding relationships and those relationships aren’t easily transferred,” said Prof. Fan in an interview with The Wall Street Journal, who has studied Li’s career. “His son may not inherit this from his father and be able to make friends with Chinese politicians.”

The elder Li’s ties to Beijing have waned under President Xi Jinping. Chinese ports are sucking up business from Li’s Hong Kong terminals, while homegrown property developers are increasingly moving in on his home turf. Victor is likely to inherit the business empire at a challenging time… Read More (PDF).

This story was reprinted by media publications around the world including Fox Business, The Australian (PDF) and Intellasia East Asia News.

Please also click the image below to view the story appeared in the print edition of The Wall Street Journal on 21 June, 2017.

Source: Dow Jones Newswires / The Wall Street Journal / Fox Business / The Australian / Intellasia East Asia News

Date published: 20 & 21 June, 2017

Photo: Bobby Yip/Reuters