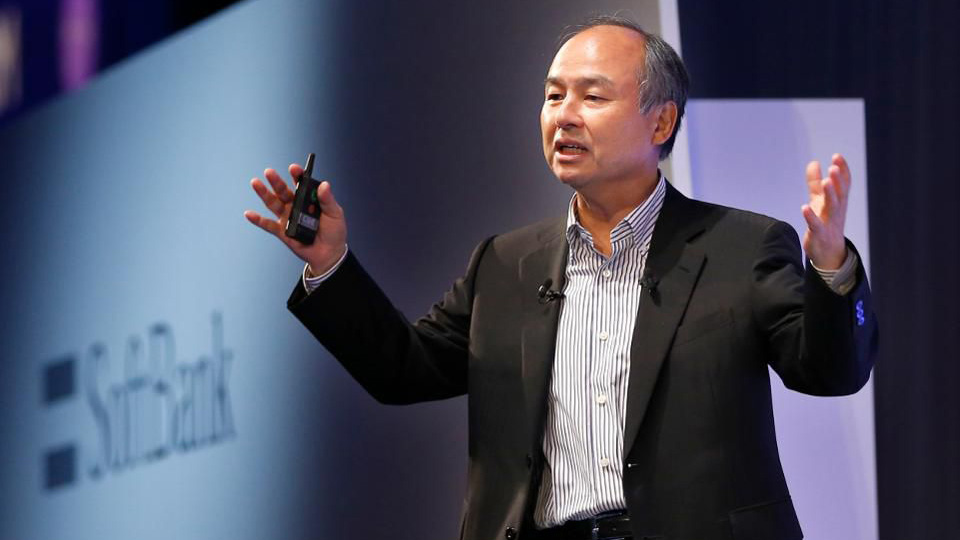

Softbank’s Masayoshi Son Seen as Clear Winner in the Ride-sharing War for Global Dominance

In an interview with Forbes, Prof. Xufei Ma comments on Didi Chuxing’s acquisition of Brazil’s 99 saying that “Didi is a skilled driver in handling relationships with investors, competitors and partners.”

China’s largest ride-hailing app Didi Chuxing has snatched up the remaining shares of Brazil’s 99 car share service, Uber’s main rival in Latin America. The news came days after Japan’s Softbank acquired a 14 percent stake in Uber, a move that helped the U.S.-based company shore up its shrinking balance sheet with fresh capital.

Newly released data shows that the embattled Silicon Valley company has accumulated nearly US$5 billion in losses in its eighth year of operation — doubling Uber’s estimated losses of US$2.5 billion in 2015. The financials were released as part of a prospectus ahead of Softbank’s acquisition.

While Softbank CEO Masayoshi Son may be seen as a white knight, his purchase comes at a bargain of US$33 a share, deflating Uber’s valuation to US$48 billion from US$70 billion at its height in the summer of 2016. Despite the 30 percent discount from Uber’s previous valuation, it’s not a bad deal to take considering the money could help fund expansion and operations to combat competitor price subsidies.

The Japanese conglomerate is not only an investor in Didi, Uber and Brazil’s 99, but also in Southeast Asia’s GrabTaxi, and India’s Ola. Softbank was an early investor in car service tech company Kuaidi Dache in 2000, which was later acquired by Didi Chuxing in 2015.

While it may seem like a conflict to invest in companies competing against each other in the same space, Son is simply “betting the race track… investing in the number one player in each of the markets,” says Xufei Ma, Associate Professor of Department of Management and Director of Centre for Entrepreneurship at The Chinese University of Hong Kong Business School in an interview with Forbes, giving the analogy of placing on all the leading horses — so long as money is not an issue.

But beyond pitting companies against one another and seeing what sticks, Son is also known for trying to figure out how to win through consolidation — much like it facilitated Didi’s acquisition of Uber China in 2016. “It’s not uncommon in today’s business world to justify ‘coopetitor’ (both a cooperator and competitor), and frenemy,” says Prof. Ma. He cited similar deals in the aviation industry between Cathay Pacific and Air China for the acquisition of Dragon Air and the equity participation of Air China in Cathay.

Didi’s venture into Brazil now marks the Chinese firm’s first move outside mainland China. Prof. Ma observes the curious timing of exactly one year since the Beijing-based company first invested in 99 as a minority shareholder. “The full control of 99 by this acquisition is a natural extension to last year’s equity participation in 99… well designed by Didi.”

Though still a young unicorn, “Didi is a skilled driver in handling relationships with investors, competitors and partners,” says Prof. Ma considering the investment in Middle East online taxi service Careem last year. The pair said they would cooperate on smart transport technology across 80 cities serving 12 million customers. Another similar investment with Estonia-based Taxify was made to cover Europe and Africa… Read More (PDF)

This story was also translated into Japanese and published in Forbes Japan. Please click here (PDF) to read the story in Japanese.

The Forbes story was widely reprinted/picked up by media publications in Vietnam including GenK, CafeF and TTVN.

Source: Forbes

Date published: 5 January, 2018

Photo: AP Photo/Shizuo Kambayashi